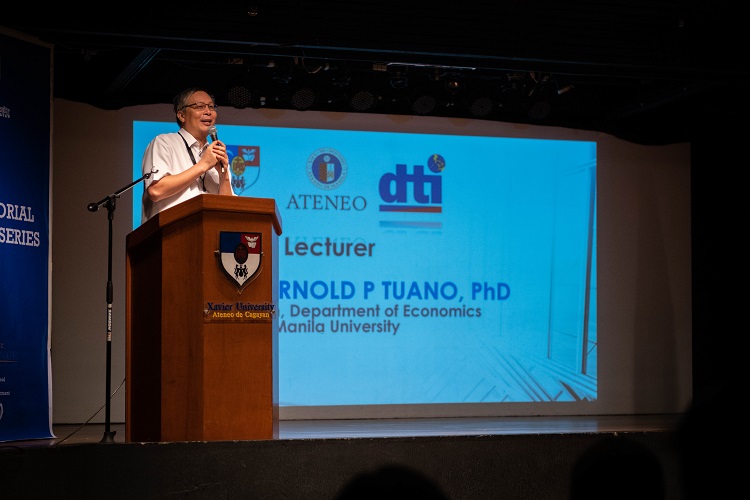

ECONOMICS EXPERT. Dr Philip Arnold P Tuaño shares on the effects of the Tax Reform for Acceleration and Inclusion Act or commonly known as TRAIN Law on various industries and social classes during a talk hosted by Xavier Ateneo.

Report by Joseph Mathieu J Dosdos

Photos by Juan Antonio Fernandez

The Department of Economics of Xavier University - Ateneo de Cagayan hosted a talk with Dr Philip Arnold P Tuaño on the effects of the Tax Reform for Acceleration and Inclusion Act or commonly known as TRAIN Law on various industries and social classes, held at the XU Little Theater on October 12.

Tuaño, who finished his master’s degree at Sussex University in England and earned his PhD from the University of the Philippines, presented the findings of his team’s intensive research and predictions for the effects of the controversial TRAIN Law.

Based on their findings, sugar-sweetened beverages, tobacco, gas, and petroleum products are predicted to be adversely impacted by the said law in terms of their rising prices, which will eventually affect the consumers.

He also pointed out a number of positive effects TRAIN law may provide to our economy, namely, helping elevate the middle class, while potentially enabling both universal health care program in the Philippines and the greater unconditional cash transfer funds to poor income households.

Tuaño, who formerly served as a director of the Macro-Policy Unit of the National Anti-Poverty Commission, currently serves as the chairperson of the Department of Economics of Ateneo de Manila Univerisity.

His presentation was then followed by reactions from the invited guests.

OPEN FORUM. In the open forum, moderated by the XU Economics Department’s faculty member Jhon Louie Sabal (left), the audience members ask Dr Philip Arnold P Tuaño (right) on macro and microeconomics concerns.

Department of Trade and Industry’s Almer Masillones explained the benefits of taxes to the audience: “We pay taxes because those are used to fund provisions of public goods and services that benefit the general welfare of the people. This includes national defense, administration of justice, internal security, the conduct of foreign policy, infrastructure, and fund programs implemented by the government. Another reason for taxation is to approach a 'more equal' society. One of the ways to redistribute wealth is with tax policy.”

Masillones emphasized that taxes have the ability "to curb badly behaving companies." She said: “Another reason for paying taxes is to correct for harmful behaviors that affect many people. This refers to negative externalities. [...] Imposing taxes on [harmful] activities can correct for negative effects on some economic activities. We pay taxes to finance projects for the common welfare, to approach a fairer society and to correct to harmful activities.”

In sharing his reaction, Alberto Daba, chief of the Regional Investigation Division of the Bureau of Internal Revenue (BIR), was quick to warn the audience about the proliferation of illegally manufactured cigarettes in the market because of the excise tax on tobacco imposed by TRAIN law, even citing some of the results of their BIR-led raids within Cagayan de Oro and Iligan.

Cagayan de Oro Chamber of Commerce representative Maria Teresa Alegrio, who is also the regional governor of Northern Mindanao Philippine Chamber of Commerce and Industry and corporate social responsibility and public relations manager at STEAG State Power Inc, also shared on the challenges that the energy sector continues to face around the country and within the Mindanao area.

Following the reactions from the invited guests, the audience got a chance to ask the speakers questions on macro and microeconomic concerns. The open forum was moderated by the XU Economics Department’s faculty member Jhon Louie Sabal.

This event was sponsored by the DTI, in celebration of Consumer Welfare Month.

In her closing message, XU Department of Economics chairwoman Caroline Laarni Sereñas shared on Benjamin Franklin’s famous line, "In this world, nothing can be said to be certain, except death and taxes.” She went on to remind the audience that our taxes serve not just protect our environment and community from "misbehaving companies" but it can serve to better our country as a whole when properly utilized.∎

TALK ON TRAIN LAW. From left to right: XU Department of Economics chairwoman Caroline Laarni Sereñas, XU College of Arts and Sciences associate dean Marichu Melendez Obedencio, Department of Trade and Industry’s Almer Masillones, Bureau of Internal Revenue's Alberto Daba, and resource speaker Dr Philip Arnold P Tuaño take a group photo after the talk on the economic effects of TRAIN Law.